When Do You Close On a New Construction Home?

Closing on a new construction home doesn’t happen on a fixed calendar date like many resale homes do. In most cases, you won’t close until the builder has finished the house. This means the timeline is tied to construction progress. If you want to know “what does house closing mean,” it means you close when the house is built and ready. Let’s go over the process of buying a new construction home in detail.

Purchase Agreement and Initial Deposit

The purchase agreement is where things start to feel real. This document outlines the home price, the lot you’re buying, and any upgrades or floor plan options you’ve selected. It also covers the builder’s new construction home timeline estimates and explains how changes or delays are handled.

You’ll also put down an initial deposit at this stage. It’s not your full down payment. Think of it as a commitment to move forward with the build. The amount depends on the builder and the local market, and it’s usually credited toward your costs at closing. Once the agreement is signed and the deposit is in, the builder can move ahead with construction.

Construction Begins and Progress Inspections

Once permits are approved, the construction starts moving in clear phases. First comes the foundation, then framing, followed by electrical, plumbing, and interior work. Each major step is checked through required inspections to make sure the home meets local building codes. These inspections happen before walls go up and again near the end of construction.

Buyers may get periodic updates or scheduled walkthroughs, depending on the builder. Also, the construction progress can be steady, but delays can still happen, mainly during inspections or material deliveries. This phase sets the groundwork for a smooth closing later.

30 Days Before Closing: Final Preparation Begins

In the last month before closing, expect a flurry of activity as the builder finalizes details and schedules the required inspections. This is also when your lender moves into high gear. The appraisal is ordered, underwriting takes a final look at your file, and you’ll be asked for updated documents. Quick responses help keep everything on track. You may lock your interest rate, review your closing disclosure, and line up homeowners’ insurance.

Now is a good time to keep your finances stable and avoid big changes, like buying a new car or financing new furniture. As approvals get finalized, you’ll get your list of paperwork needed for the closing date, and the final steps will happen.

Certificate of Occupancy Issued

The local building department conducts a final inspection and issues the certificate of occupancy. This step confirms the house meets the required safety and building standards and is cleared for move-in. Until that approval is in place, closing cannot happen. Once the certificate is issued, the builder can set a closing date and let the bank and title company finish their work.

Final Walk-Through on New Construction Home and Punch List

The final walkthrough normally happens a few days before closing. You’ll walk through the house to confirm everything is as agreed upon in the contract. Check the paint, hardware, appliances, and those basic things like lights, outlets, and plumbing work. The whole purpose is to make sure the place is complete and everything is functioning properly.

Any issues you notice are documented on a punch list. Usually, these are minor things like paint touch-ups, trim repairs, or some pending adjustments. Depending on the builder, these may be handled before closing or shortly after. Move through the walkthrough carefully and speak up. Getting these details documented now helps avoid problems later.

Factors That Can Delay Your Closing Date

Many times, new construction is not ready by closing, and inspections are a frequent cause. If a local inspector finds something wrong, the builder must correct it and arrange another inspection, and this delays things. The weather also plays a role. Major rainfall, extreme heat, or cold periods can delay outdoor work and final sign-offs.

Material delays also play a major role. Backordered appliances, flooring, or fixtures can push completion dates back. On the buyer side, financing can cause hold-ups. Updated pay stubs, bank statements, or changes in credit can pause underwriting. Appraisal delays are another frequent issue, especially in busy markets.

The Closing Day Process for New Construction

The closing day mainly involves finishing the paperwork and double-checking the details. You’ll look over and sign your loan papers, check the closing numbers, and approve the final expenses. The builder confirms the home is complete, and the title company records the transaction. After this, the funds are released, and the house is officially yours.

When Do You Start Paying the Mortgage on a New Build

Mortgage payments typically start about 30 to 45 days after closing, not right away. Your exact first payment date will be listed in your closing paperwork. Interest is prepaid at closing for the remaining days of the month, which is why there’s a short gap before the first bill arrives. This gives you time to settle in, handle moving costs, and adjust to your new monthly budget before regular payments begin.

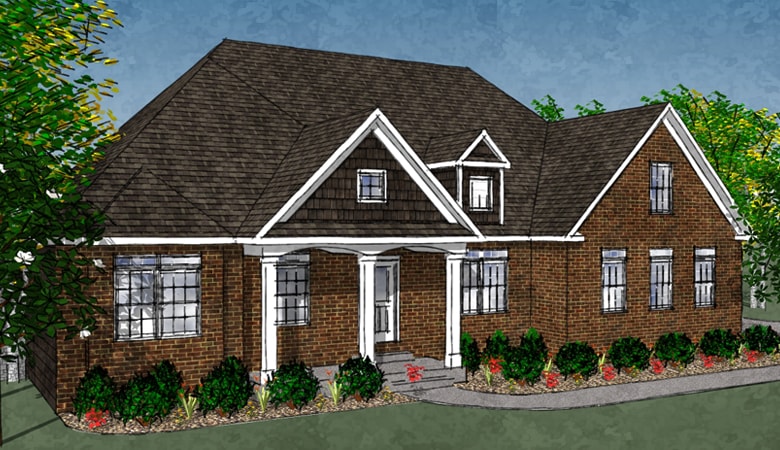

Explore Custom Floor Plans from Steiner Homes

When you’re buying a new home, having a clear idea of timelines and closing dates makes the entire process easier. That’s where Steiner Homes pitches in. We focus on planning, flexible designs, and open talks. So, if you also want a new home with a custom floor plan, let’s talk. Contact us to see design options, discuss changes, and proceed confidently, knowing what to expect.